Should You Prepare for a

Stock Market Crash?

According to a study by the National Bureau of Economic Research titled “Crash Beliefs From Investor Surveys,” the average investor believes there is a 20 percent plus chance of a 1987-magnitude crash (when the Dow Jones Industrial Average dropped 22.6 percent in a single session) or 1929-magnitude crash (when the Dow dropped 12.8 percent in a single session). These were the worst single-day plunges since the Dow’s inception in 1896.

The study is based on periodic surveys conducted since 1989 that ask investors to assess the risk of a 1987- or 1929-magnitude crash over the next six months. Over the past three decades, the perceived risk averaged 19 percent. In the most recent survey, it was 22.2 percent.

That doesn’t mean a crash will happen. According to the study authors, investors tend to believe crash probabilities are higher during bear markets. And crash probabilities tend to rise after an increase in the number of references to a “crash” in the media.

Still, when markets are volatile, it’s a good idea to review your portfolio with your financial adviser. He or she can tell you if you’re set up in a way that meets your investing goals and your risk tolerance over the long term.

Do you know your risk tolerance? It turns out that 4 out of 5 people have more risk in their portfolios than they realize.

Discover your Risk Number by taking our quick 5 minute quiz:

Like Your Car, Your Portfolio Needs Regular Checkups

Good or poor performance of one or more components of your portfolio can provide a drastic change in the allocation of your assets and create dangerous imbalances that result in inadvertent risk-taking. As a result, your financial adviser will recommend regular checkups. Don’t wait for spring; why not do it now?

The first step your financial adviser will take is to evaluate your portfolio. Do your actual investments match up to your target investments?

If they do, your portfolio is in good shape. But if they’re off, your financial adviser will want to determine how far off they are. He or she might not recommend altering your asset mix unless the discrepancy is significant, but every situation differs.

If your portfolio is seriously off balance, your financial adviser may rebalance it. After all, the ultimate goal is to keep your portfolio’s overall risk level under control.

To do that, he or she may shift funds out of the asset class that exceeds its target into other investments, add funds to the asset class that falls below its target percentage, or direct dividends from the asset class that exceeds its target into the ones that are below their targets.

Your adviser may also want to determine if the investments in each asset class are still appropriate. That doesn’t mean he or she will recommend selling poorly performing investments and adding investments that may deliver better performance; they may be doing just fine for the type of investments they are.

Would you like to learn more about your portfolio and how it is allocated? Please contact us to discover our reporting options and financial plans.

From Peanuts to Gluten: Dining Out with Food Allergies

When you suffer from food allergies, dining out can be a worrisome prospect. But food allergies don’t have to keep you in! Here’s how to dine out safely and enjoyably.

Prepare: Since not all restaurants are allergy aware and few list the ingredients they use, it’s smart to check the restaurant’s website and menu before you go. Search for foods you know are safe. Then phone ahead and talk with the manager or chef, just to be sure.

Choose carefully: Some kinds of restaurants are riskier than others. For example, Asian restaurants are more likely to use peanut oil. Seafood restaurants have a greater risk of shellfish contamination.

Communicate: Don’t be embarrassed about having a heart-to-heart with your server. Explain your concerns and make sure your server understands. Plan to visit during off-peak hours when the wait staff and kitchen are more likely to pay careful attention to your requests.

Beware of cross-contamination: Avoid buffets and food outlets where utensils and equipment may experience cross-contamination. Ask your server to confirm that the kitchen will use fresh oil and clean utensils to prepare your meal.

Protect youngsters: If you are dining out with a child who has allergies, bring food with you that you can substitute if the menu is inadequate.

Take precautions: Tell your companions what to do in an emergency and have your epinephrine auto-injector close at hand. (WebMD suggests you carry two.)

Be responsible: If you don’t feel completely safe, leave. It’s your health!

Financial Term of the Month

Fixed Asset - “A tangible, long-term asset used for the business and not expected to be sold or otherwise converted into cash during the current or upcoming fiscal year is called a fixed asset. Fixed assets are items like furniture, computer equipment, and real estate.”

Ready to take control of your financial future?

Check out our free goal analyzer:

Worth Reading

How to See a Memory

By Helen Shen

Nature.com

Find it hard to remember things? Try describing what a memory looks like. Researchers have been studying the brain for years, trying to determine how and where in the brain memories form. Their goal is to find the “engram”: the physical trace of a single memory. Helen Shen reviews past and current memory research; memory-making may be more complex than we thought.

How Dirt Could Save Humanity from an Infectious Apocalypse

By Peter Andrey Smith

Wired.com

Enjoy gardening? Did you know the dirt between your fingers could help save your life? Sean Brady is a chemist who is determined to find undiscovered antibiotics in dirt. As diseases become increasingly resistant to antibiotics, many fear an “Infectious Apocalypse.” Brady doesn’t limit his search to gardens; he tests pretty much everywhere. His methods aren’t without detractors, however. This piece explains it all.

Benjamin Franklin Built His Character Around 13 Virtues …

By Trent Hamm

From The Simple Dollar, reprinted in Business Insider

If Benjamin Franklin were alive today, he could have had a great career as a life coach. Franklin resolved to live his life by 13 core virtues, and created a system to track his progress. This article explains each virtue and gives tips on creating your own Franklin-styled improvement system.

Life Insurance Strategies: Three Reasons Empty Nesters May Want Permanent Coverage

Parents with young children might worry about whether they have enough life insurance to take care of their family’s financial needs if they should pass away. But as their children grow into self-supporting adults, they might start to consider whether they still need life insurance at all.

A whole life policy typically provides a permanent death benefit, as long as the premiums are paid to keep the policy in force. A portion of the insurance premium goes into a cash-value account, which accumulates on a tax-deferred basis. Not only could this increase the death benefit, but it provides some financial flexibility because you can tap into the cash value during your lifetime.

Here are three reasons why a permanent policy could play an important role in your long-term financial plan.

1. Protect Your Spouse

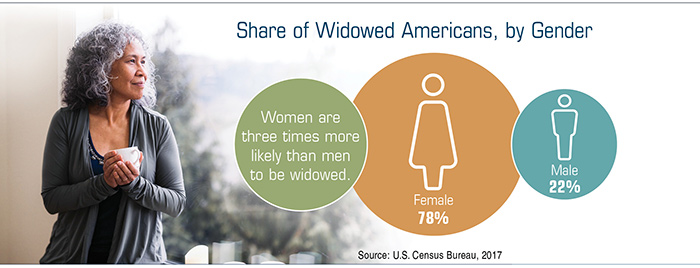

Regardless of your age, your spouse might depend on your income, especially if you are still working and/or have a mortgage that could be paid off with a life insurance benefit. If you are already retired, losing one spouse’s Social Security benefit could also make it difficult for the surviving spouse to continue paying the same fixed living expenses, despite any survivor benefits. Even if your surviving spouse can count on a similar retirement income, he or she may face higher taxes on that income when filing as an individual than you do now as a couple filing jointly. Life insurance could be used to help offset an expected after-tax income gap.

2. Supplement Your Retirement Income

The cash value is available for emergencies as well as for normal retirement expenses such as housing costs and health care. You can generally make tax-free withdrawals (up to the amount paid in premiums) or use loans to tap into the accumulated cash value. Although policy loans accrue interest, they are free of income tax (as long as they are repaid) and usually do not impose a set schedule for repayment.

Still, you should generally have a need for life insurance protection and evaluate a policy based on its merits as such. Keep in mind that loans from a life insurance policy will reduce the policy’s cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured. Additional out-of-pocket payments may be needed if actual dividends or investment returns decrease, if you withdraw policy cash values, or if current charges increase.

3. Leave a Legacy

The death benefit could fund an inheritance for your loved ones or a charitable bequest. It could also provide liquidity that may be needed to divide estate assets equally among your children or meet potential estate tax obligations. Having cash available could help prevent your heirs from being forced to sell important assets they may prefer to keep, such as a family home, farm, or business.

Before implementing a strategy involving life insurance, it would be prudent to make sure you are insurable. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. In addition to the life insurance premiums, other costs include mortality and expense charges. If a policy is surrendered prematurely, there may be surrender charges and income tax implications. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.

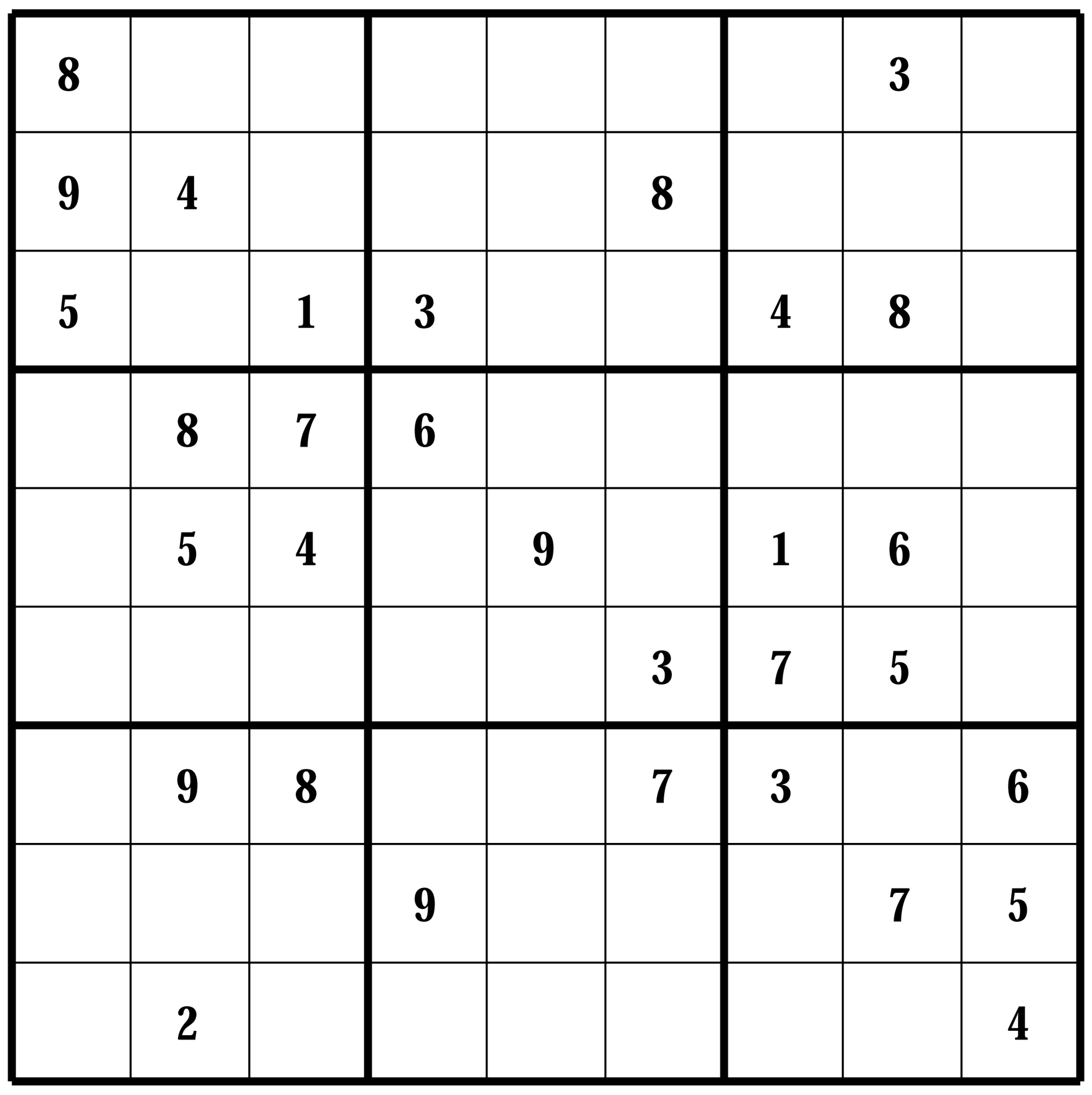

Sudoku instructions: Complete the 9 × 9 grid so that each row, each column and each of the nine 3 × 3 boxes contains the digits 1 through 9. Contact me for the solution!

This newsletter and any information contained herein are intended for general informational purposes only and should not be construed as legal, financial or medical advice. The publisher takes great efforts to ensure the accuracy of information contained in this newsletter. However, we will not be responsible at any time for any errors or omissions or any damages, howsoever caused, that result from its use. Seek competent professional advice and/or legal counsel with respect to any matter discussed or published in this newsletter.

Roasted Piri Piri Chicken

Serves 4

2-3 pound whole chicken

Juice of 2 lemons, plus zest

¼ cup extra virgin olive oil

1 tablespoon chili powder

or crushed chili, or to taste

2 teaspoons salt

1 clove garlic, crushed

1 piece of ginger, peeled

and grated

Directions

Mix together all of the ingredients for the marinade and place chicken and marinade in a plastic bag and refrigerate.

Massage and turn frequently and marinate for at least two hours or preferably overnight.

Preheat the oven to 450° F. Place the chicken and marinade in a baking tray and roast for about an hour or until cooked through, basting occasionally during cooking.

Once cooked, remove from oven and rest for 15 minutes, reserving cooking juice.

Carve and serve with crusty bread, a green salad with olives and the piri-piri juice.

Aequitas Equitas Investment Group Newsletter is brought to you free by:

Brent E. Chavez

Aequitas Equitas Investment Group

3160 Bedminster Rd

PO BOX C

Bedminster, PA 18910

(215) 766-7002

Investment advisory services offered through Motiv8 Investments, an SEC Registered Investment Advisor